If you’ve missed the deadline to file your income tax returns, there’s no need to panic. You still have the option to file your tax returns after the due date, although with a penalty. This article provides a comprehensive guide on understanding and filing belated returns, ensuring you navigate the process smoothly while avoiding potential financial penalties.

What is Belated Return?

A belated return is a return filed after the deadline i.e. 31st July of the assessment year but before 31st December of the assessment year. While late filing has consequences, it’s still better than facing potential penalties for non-compliance.

Bạn đang xem: Belated Return: Section 139(4), Penalty, How to File Income Tax Return After Due Date?

The due date to file income tax return for the Financial Year 2023-24 is 31st July 2024. If you miss filing your ITR within the original deadline, then you can file a late return, known as Belated Return.

Filing ITR for Previous Year

If you missed filing ITR for previous year within due date, you can file a belated return on or before 31st December of the relevant assessment year. For Example, for the AY 2024-25, the timeline to file a belated return is on or before 31 December 2024. In case you miss the belated return deadline, then you may file ITR-U in certain specified cases. The amendment vide Finance Act 2021 reduced the timeline of filing the belated return. With effect from AY 2021-22, you can file the belated return three months before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier.

Drawbacks of Filing Late Return

The following are the disadvantages of filing a belated return:

- Interest may be applicable under sections 234A, 234B and 234C.

- A late fee will be levied under Section 234F while filing a belated return:

- If you have incurred losses, like business and capital losses, they cannot be carried forward and set off in the subsequent years. However, an exception is available for losses from house property that can be carried forward even if you file your returns late.

- Deductions/ Exemptions Disallowed: Deductions/ exemptions u/s 10A, 10B, 80-IA, 80-IB, 80-IC, 80-ID and 80-IE shall not be available if you delay ITR filing. These tax-saving benefits are allowed only if the ITR is filed before the original deadline.

How to File Belated Returns?

Belated return u/s 139(4) can be in the usual manner on Cleartax. Refer to this page for a detailed guide.

If you wish to file it on Income Tax Portal, take a look at this step-by-step guide on how to file a belated return online and offline.

Online Method

Xem thêm : अलंकार की परिभाषा, भेद, उपभेद और उदाहरण – Alankar in Hindi

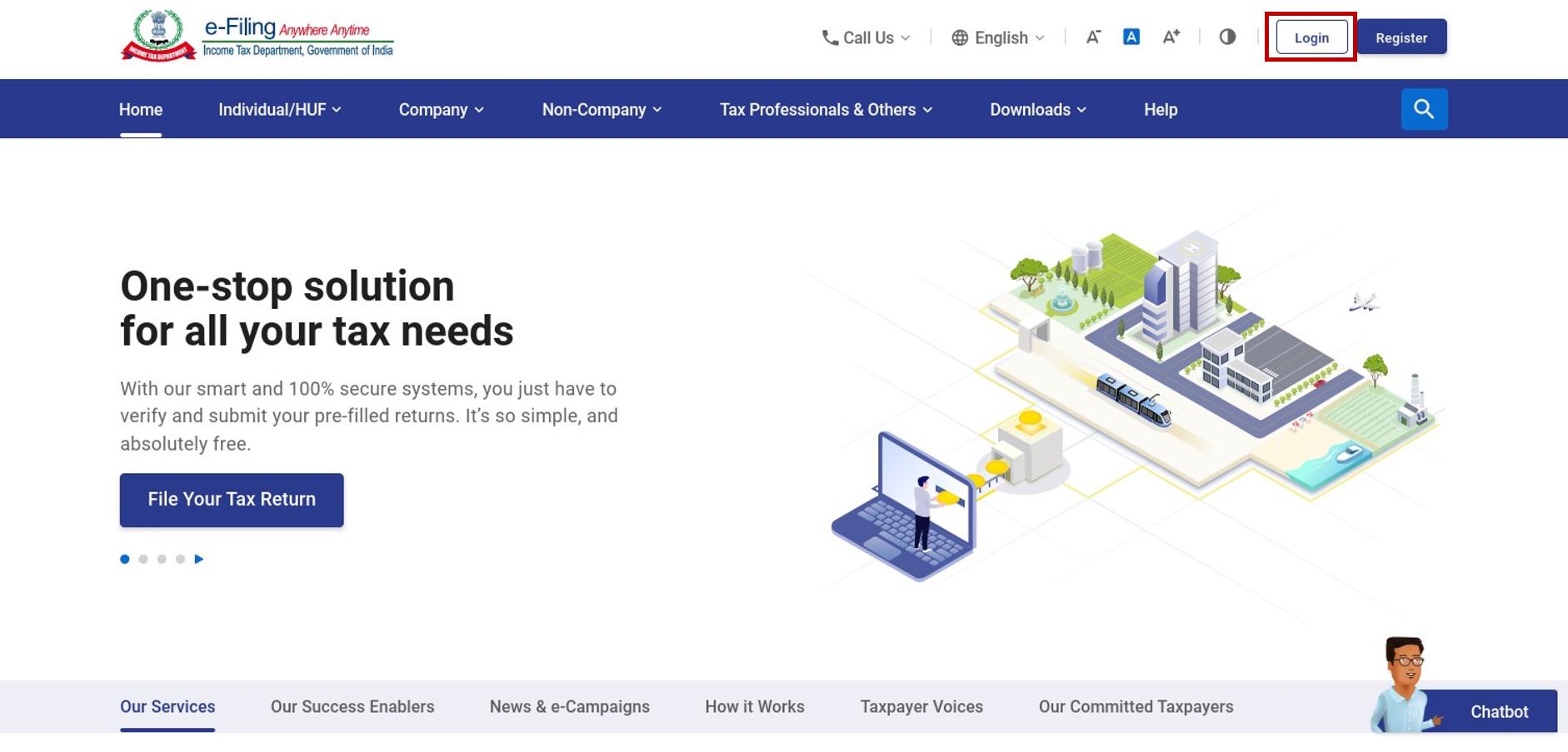

Step 1: Log in to your account on the e-filing account

Step 2: Click on ‘e-File‘ > Choose ‘Income Tax Returns‘ and > Select ‘File Income Tax Return‘

Step 3: Select the relevant assessment year

Step 4: If you select the mode of filing as ‘Online’, follow Steps 5-10.

Step 5: Click on the ‘Start new filing’ button

Step 6: Select the applicable status

Step 7: Now, select the applicable ITR form

Step 8: Click on the ‘Personal Information’ section and ensure all your personal details are correct.

Step 9: Scroll down to the filing section and select 139(4).

Step 10: Fill in all your income details under various source heads and proceed to make the tax payment.

Offline Method

Download Offline ITR Preparation Utility and prepare the ITR. Once done, upload .json file and proceed to verification.

How to File the Missed Returns For FY 2023-24

If you missed filing a return within the original deadline, you can file a belated return within 31st December of the relevant assessment year. If you miss this deadline too because of genuine reasons then you may file a condonation of delay request and ask the income tax authorities to condone the delay.

- Request the Income Tax Commissioner or the prescribed authority to permit you to file income tax returns and state the reason for missing the deadline. The officer can accept your request based on the following criteria:

- The claim is correct and genuine.

- The case is based on genuine hardship of merits.

- A refund has resulted due to excess tax deduction, TDS, advance tax, or self-assessment tax.

- Any other person cannot assess the tax under the Income Tax Act.

- If you have not paid the tax for FY 2023-24, you must pay the tax along with applicable interest under Section 234A, 234B, or 234C. You must pay the tax even if you are unable to file your income tax returns.

- It may so happen that you have paid your taxes on time but missed filing returns. In this case, you cannot file returns or apply for a condonation of delay. The income tax department may issue a notice under Section 271F for not filing ITR. You may have to pay a penalty of up to Rs.5,000 for missing the deadline. If you have a genuine explanation for not filing and if the officer is satisfied with the reason, you may not have to pay the penalty.

- The income tax department can take legal action against you for not filing returns, such as issuing a notice and penalizing you. In the worst-case scenario, you may be prosecuted and a sentence of imprisonment for up to seven years.

- If you receive a notice from the income tax department, you must respond to it on the income tax e-filing portal and file the ITR to comply with the notice.

- If you have under-reported the income, a penalty of up to 200% of the tax payable will be levied. In case the taxpayer has paid taxes with interest after the deadline but has under-reported the income, the assessing officer may excuse his penalty, and no penalty will be levied on him. Though there is an alternative in case you miss ITR filing by the due date, it is recommended to file returns by 31 July of the assessment year. For e.g., you should file your ITR by 31st July 2024 for the FY 2023-24.

What to Do If You Receive a Late Payment Notice

If you have received a notice from the Income Tax Department asking you to file your returns that go beyond 2 financial years, you can log on to www.cleartax.in to prepare your returns. You can then print this return and submit it to the income tax office in your ward. Usually, a taxpayer files an old return in response to an income tax notice.

- Delayed returns cannot be revised. However, from FY 2016-17, a belated return can also be revised.

- You cannot carry forward some losses that belong to the years for which you did not file returns. However, an exception is available for losses from house property that can be carried forward even if you file your returns late.

For better understanding, read more related articles:

- How to file ITR

- Income Tax Department Portal – Login & Registration Guide

- incometaxindiaefiling.gov.in – Income Tax e-Filing Guide

- Income Tax E-Filing with ClearTax

- Income Tax Slab

- What is Form 16

- Check your Income Tax Refund Status Online

Nguồn: https://tromino.eu

Danh mục: शिक्षा

This post was last modified on November 19, 2024 1:49 pm